Marx Realty said private equity firm Vialto Group has signed on for an additional 10,000 square feet of space at 545 Madison, expanding its presence in the building to 17,500 square feet. The firm’s space commitment now spans two floors at the Plaza District office building. The building became known as the Baccarat Building after Marx Realty forged a co-branding partnership with Baccarat.

“The hotel-like sensibility, combined with our commitment to creating beautiful spaces, in this case in partnership with Baccarat, continues to attract high-profile tenants seeking a top-to-bottom sensory experience,” said Craig Deitelzweig, president and CEO of Marx Realty. “As is typical across our portfolio in New York and DC, existing tenants almost always choose to grow in place at Marx properties, and we’re thrilled to see Vialto more than doubling its footprint at 545 Madison.”

A Cushman & Wakefield team led by Tara Stacom represented Marx Realty while David Dusek, also of Cushman & Wakefield represented Vialto Group

Private Equity Firm Vialto Group Expands to 17,500 SF at 545 Madison Avenue

October 15, 2025

Private equity firm Vialto Group has signed up for an additional 10,000 square feet at Marx Realty’s 545 Madison Avenue office tower, bringing the firm’s total footprint to 17,500 square feet across two full floors, Marx announced.

Asking rent for the new 10,000-square-foot space was $95 per square foot, according to Marx. The asking rent for office space in the 17-story tower ranges between $95 and $165 per square foot. Vialto Group moved into 545 Madison in 2022.

Tara Stacom of Cushman & Wakefield represented Marx Realty in this deal, while C&W’s David Dusek represented Vialto Group. C&W did not immediately respond to a request for comment on this deal.

“As is typical across our portfolio in New York and D.C., existing tenants almost always choose to grow in place at Marx properties, and we’re thrilled to see Vialto more than doubling its footprint at 545 Madison,” Craig Deitelzweig, president and CEO of Marx Realty, said in a statement announcing the expansion. “The hospitality-infused, club-like aesthetic we pioneered is just that special.”

545 Madison Avenue is also known as the Baccarat Building, thanks to a co-branding partnership between the lifestyle house Baccarat and Marx Realty. Other corporate tenants at the building include Marx Realty, private investment firm BellTower Partners, and financial software and applications developer GTS.

Vialto Group more than doubles footprint at 545 Madison Ave.

Vialto Group’s Midtown office now spans two floors at 545 Madison Ave.

Peter Murdock

By Julian Nazar – Staff Reporter, New York Business Journal

October 15, 2025

Vialto Group more than doubles footprint at 545 Madison Ave.

Vialto Group’s Midtown office now spans two floors at 545 Madison Ave.

Peter Murdock

By Julian Nazar – Staff Reporter, New York Business Journal

Vialto Group has more than doubled its office footprint at Manhattan office tower 545 Madison Ave.

The private equity firm, which occupies 7,500 square feet on the 14th floor, is adding a 10,000-square-foot space on the second floor. This brings Vialto’s total footprint to 17,500 square feet across two full floors of the 18-story, 140,000-square-foot building.

The lease renewal is for 10 years. Asking rent for the second-floor space was $95 per square foot. Asking rents in the building range from $95 to $165 per square foot.

A Cushman & Wakefield team led by Tara Stacom represented Marx Realty on the deal. The firm’s David Dusek represented Vialto Group.

“The hotel-like sensibility, combined with our commitment to creating beautiful spaces, in this case in partnership with Baccarat, continues to attract high-profile tenants seeking a top-to-bottom sensory experience,” said Craig Deitelzweig, president and CEO of Marx Realty, in a statement.

Now called the “Baccarat Building,” 545 Madison Ave. is home to tenants such as French luxury crystal line Baccarat, health care investment platform Consonance Capital and private investment firm Orangewod Partners. The property is 90% leased.

Tales from New York’s cautious office comebackOctober 1, 2025

Institutional investors still avoid broad bets on the sector, but painstakingly selected niches are doing well

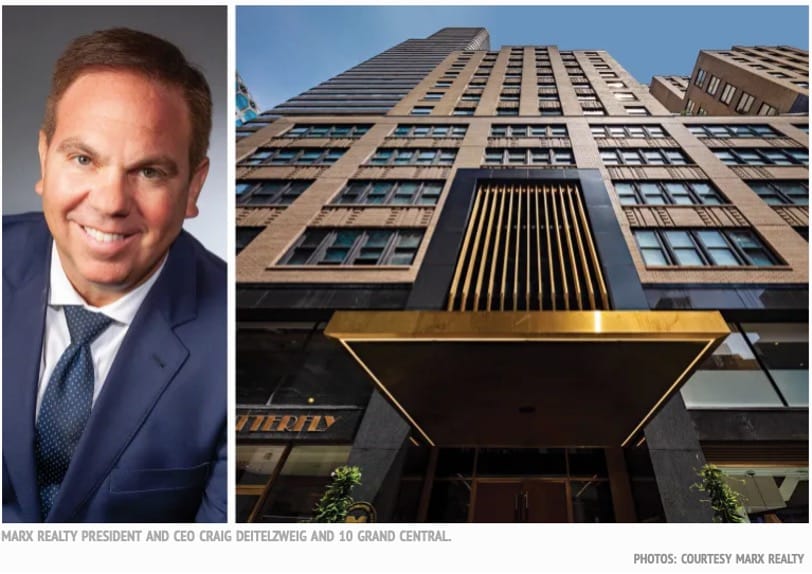

Marx Realty’s 35-story building at 10 Grand Central is nearly full. Craig Deitelzweig, Marx’s CEO, did a multi-million-dollar renovation, adding hotel-like amenities to the drab office that used to go by 708 Third Avenue. Tenant demand is now so furious Deitelzweig raised rents four times in the past year.

“It’s one of the strongest office markets that we’ve seen in a decade,” he said.

Not all New York City office dealmakers will make a claim like that, but most will acknowledge the comeback in a sector that descended into the edges of hell during Covid only to remain in purgatory for years.

Earlier this year, New York City recorded the lowest office vacancy rate of any major city, according to Moody’s. Foot traffic has exceeded pre-pandemic numbers, Placer.ai data shows. And new leasing in Midtown rose to 5.3 million square feet in the second quarter, its highest mark since 2019, according to a report from Cushman & Wakefield.

News from the leasing market has spurred big-ticket deals. RXR’s recent purchase of 590 Madison Avenue, a 1 million-square-foot tower formerly home to IBM, was the first sale of over $1 billion since 2022.

“590 Madison was finally the culmination of all the trends that we were seeing and the conversations we’ve been having that the market was finally ready to get a billion-dollar-plus single asset sale done,” said Gary Phillips, managing director of Eastdil Secured, who brokered the deal.

Another sign of a comeback: Blackstone is looking at the sector. When Jon Gray and the trillion-dollar Blackstone operation put their money into something, others follow. In June, the firm made one of its first moves into office since Covid, acquiring a large stake in Fisher Brothers’ 1345 Sixth Avenue. It also bid on 590 Madison and on Paramount Group, the New York City and San Francisco office landlord with 13 million square feet of Class A office space that reached a deal to sell to Rithm Capital in September.

Meanwhile, Related Companies might build a new office at 625 Madison Avenue, where it had planned a 1,220-foot, 68-story supertall with residential, hotel and retail. The pivot would be to an “AA-class office tower.”

Padding the environment, the Federal Reserve finally lowered the federal funds rate in September, while suggesting future rate cuts. CBRE already expects an uptick in deals.

But the scope of the office comeback is unclear. Institutional investors are still not making broad bets on office, but are surgically picking spots in sub-markets within a sub-market. At the same time, an untold amount of distress is playing out behind the scenes with lenders.

“I’d say it’s early days of a recovery in office,” said Spencer Garfield, co-head of CRE credit at Fortress Investment Group. “But that recovery is underway, and there’s still pain to be had, because there are still over-levered properties, and there are still poorly run properties and undercapitalized sponsors.”

Return journey

New York City’s office comeback story started with leasing.

With new construction virtually stopped and the trophy towers of One Vanderbilt, Hudson Yards and Manhattan West filled up, companies searching for space looked elsewhere.

They first turned to Park Avenue because of its close proximity to Grand Central, which seemed more convenient than ever for employees returning to the office, especially from the Northern suburbs. With its historic reputation as the premier office address, vacancy rates for Park Avenue declined to less than 10 percent in 2024, far below the city’s average, according to CoStar.

Park Avenue building owners opted to spend tens of millions on amenities and upgrades.

Aby Rosen’s RFR Holdings put about $30 million into the Seagram Building, considered the Rolls-Royce of buildings when it was built in the late ’50s. It’s now fully occupied, averaging leases in the mid-$200s per square foot. Some tenants at Seagram are making forward commitments for 2027 and 2028, son Gaby Rosen noted, because of concerns about finding space in the area.

“Even though the overall market availability rate is still relatively very high, there is a lack of supply of big block space,” Gaby Rosen of RFR said. “And there happen to be 30 to 40 tenants right now in the market looking for big block space in and around Grand Central and Midtown East.”

Such tenants scour Midtown for buildings with their desired amenities, including modern lobbies, high ceilings and spacious conference rooms. Options have been limited. Amazon, which needed to find a place for its 350,000 corporate employees returning to the office, inked a 330,000-square-foot lease at Property & Building Corp’s 10 Bryant Park, a 1980s office tower with extensive upgrades. It also enlisted WeWork to lease even more space on its behalf.

“There happen to be 30 to 40 tenants right now in the market looking for big block space in and around Grand Central and Midtown East,” said Aby Rosen of RFR.

Yet institutional investors remained on the sidelines. No one wanted to be the first mover, and other business lines, such as private credit, offered returns of over 15 percent, too lucrative for investment giants to pass up.

Marx Realty Expands to 11K SF at 10 Grand CentralAugust 11, 2025

The real estate company, whose portfolio also includes 545 Madison Avenue in Manhattan and 1307 New York Avenue in Washington, D.C., signed a 10-year deal for the new space at an asking rent of $94 per square foot. Marx represented itself in this deal.

Once Marx vacates its previous space in the building, retail company 1-800-Flowers will move into the 9,000-square-foot space on the 7th floor, vacating its sublease on the 18th floor, Marx said in the announcement.

1-800-Flowers signed a five-year deal at an asking rent of $88 per square foot. Chris Foerch of Savills represented 1-800-Flowers in this deal. Savills did not immediately respond to a request for comment.

“Securing prime real estate in New York City represents our continued commitment to strengthening our presence in one of the world’s most dynamic markets,” Dennis Marnick, head of real estate for 1-800-Flowers, told Commercial Observer via email. “The space continues to enable us to better serve our customers while supporting our talented team with a modern, collaborative environment that reflects our innovative approach to connecting people through meaningful moments and celebrations.”

10 Grand Central will be getting a brand new tenant when UK-based alternative asset management platform Hayfin Capital Management takes over 7,000 square feet on the 16th floor, Marx said. Hayfin will eventually move from its current office at the GM Building, also known as 767 5th Avenue. The firm signed a seven-year deal at an asking rent of $92 per square foot.

CBRE brokers Arkady Smolyansky, Masha Dudelzak, Jacob Rosenthal and Gerry Miovski represented Hayfin. CBRE did not immediately respond to a request for comment.

Mitchell Konsker, Thomas Swartz, Carlee Palmer and Nicole Danyi from JLL represented Marx Realty.

“Marx is leading the market with the best in amenities, which is resonating with the tenant community and has increased velocity and rent premiums,” Konsker said in an email to CO.

Mark recently completed some new amenity offerings at 10 Grand Central. The meeting galleries are a new 11,000-square-foot amenity comprising four reservable spaces to accommodate board meetings, corporate retreats, company gatherings, product launches, team building activities and even podcast productions.

10 Grand Central gets revampAugust 10, 2025

By Steve Cuozzo

When an office tower’s landlord has to move its own headquarters to make room for another tenant there, it likely means the building’s hot.

It’s happening at Marx Realty’s 10 Grand Central, the 450,000 square-foot Art Deco property previously known as 708 Third Ave. Marx CEO Craig Deitelzweig had the idea in 2018 to ditch the then-unfashionable avenue moniker as part of a $45 million repositioning that included moving the entrance to East 44th St.

It’s been a leasing juggernaut ever since. Some 27,000 square feet of new deals brought its offices to more than 95% spoken for.

Marx will expand from its current 9,000 square feet on the seventh floor to 11,000 square feet on the 11th floor. The move will make more room for 1-800-Flowers, which will move into Marx’s old space from a smaller sublease on the 18th floor.

“I never saw before in my 24-year career so many tenants expanding or wanting to,” Deitelzweig told us.

Alternative asset management platform Hayfin Capital Management will relocate from the GM Building to a similar-sized, 7,000 square-foot space on 10 Grand Central’s 16th floor — which became available when Teladoc expanded to the 17th floor.

He said companies hesitated to grow during and soon after the pandemic “thinking hybrid work would last forever. Now, people are in their offices four or five days a week.”

He said Marx has raised rents at 10 GCT four times in the past 12 months “from $82 per square foot to $130,” and soon to $230 on two formerly mechanical floors at the top being converted to offices with “all-glass” surroundings.

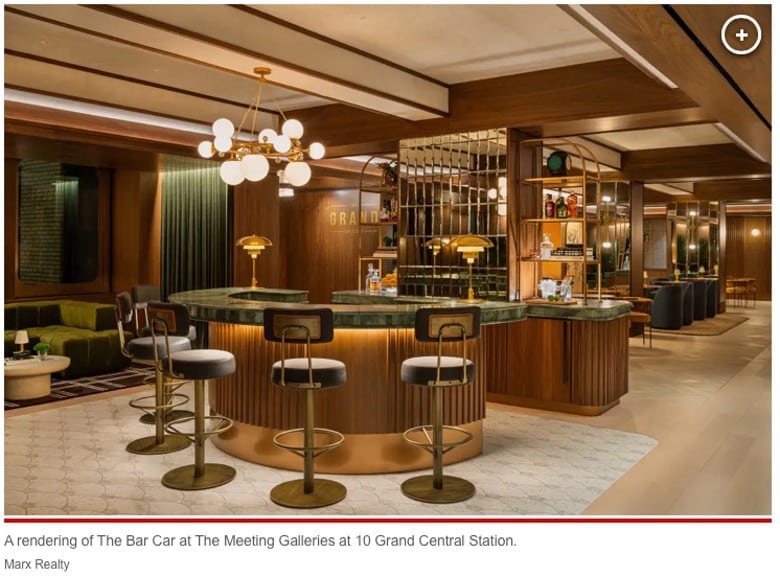

A new draw is The Meeting Galleries, an 11,000 square-foot amenities complex of four different spaces to accommodate corporate meetings and events, including a “Town Hall” lounge. Seats, murals and artworks were chosen to suggest a luxury train of the 1930s.

Marx Realty inks 19,000 s/f lease renewals/expansionsJuly 8, 2025

Manhattan, NY Marx Realty (MNPP) said that investment advisory firm, Family Management Corp. is more than doubling its footprint at 10 Grand Central expanding from 4,800 s/f to 11,000 s/f with a seven-year term. Weidenbaum & Harari, a New York-based law firm focused on serving the legal needs of the real estate and construction industries, renewed its 8,000 s/f lease for a seven-year term. The recent activity comes on the heels of the completion of The Meeting Galleries, a new 11,000 s/f amenity comprising four reservable spaces to accommodate board meetings, corporate retreats, company gatherings, product launches, team building activities, podcast productions and much more.

JLL’s Mitchell Konsker, Carlee Palmer, Thomas Schwartz, and Nicole Danyi are leading a team handling the leasing for Marx Realty. Family Management Corp. was represented by Rob Silver of Newmark. Weidenbaum & Harari was represented by Doug Levine of Newmark.

“We began taking reservations for The Meeting Galleries spaces well before construction was complete and consistently receive enthusiastic feedback from existing and potential tenants as well as brokers touring the building,” said Craig Deitelzweig. “The recent renewal and expansion were driven by our best-in-market, premier amenity offering which redefined the workplace experience before the market knew it needed to be rethought.”

From a next-generation ‘town hall’ meeting lounge with seating for 200 to pre-function, podcast and theater rooms, The Meeting Galleries exudes a luxury train liner aesthetic that complements the well-received 7th floor club lounge and terrace. The new space harkens back to the 1930s when hospitality was king and white glove experiences were reserved only for the elite while punctuating a hospitality-infused package that combines workspace functionality and luxury hotel ambiance.

The Meeting Galleries consists of four defined spaces: The Bar Car (a pre-function space outfitted with Baccarat accessories and barware); The Grand Gallery (a meeting lounge unlike any other with space for 200 participants in an exceptional setting with grand arched ceilings); The PodCast Gallery (a bespoke sound-attenuated space equipped with technology needed to produce and record podcasts); and The Screening Gallery (a theater with plush stadium seating and a 150” screen).

The Bar Car – the dramatic pre-function space – includes a floor-to-ceiling bronze fireplace and a green stone bar accented with open shelving and integrated mirror panels to provide a striking entrance into the space. The includes a variety of plush velvet seating options and warm walnut wood panels throughout to accent the inviting experience. Distinctive art pieces fashioned in oxidized copper and graceful, gold-backed murals will lend an art gallery-like quality to the space while windows with soft, rounded edges mimic those found on train liners and infuse the space with natural light. Private nooks with fold-down tables, similar to those found in a luxury train car, add timeless sophistication and contemporary functionality to the space.

Artwork inspired by Guastavino tiles adorns the Grand Gallery with a distinctive sensibility reminiscent of the many spaces in Grand Central Terminal while offering a variety of plush seating options, a burl-wood backdrop, hardwood flooring and regal burnt orange carpeting. The Podcast Gallery is framed with a half wall of fluted glass – including an ‘on air’ lighted sign — and is equipped with the latest technology for production and recording functions. Inside the Screening Gallery, the ceiling is peppered with pin lights to simulate the constellation-inspired ceiling at Grand Central Terminal and offers tenants the opportunity to watch movies or training videos, hold team-building gatherings or connect with colleagues around the world via video conferencing.

Asking rents at 10 Grand Central range from $82-140 per square foot.

The Meeting Galleries is the latest evolution of Marx Realty’s hospitality-infused renovation at 10 Grand Central which, in 2018, included a stunning new façade with marquee brass fins and oversized walnut doors, attended by a uniformed doorman, as well as a redesigned lobby featuring walnut wood and brushed brass accents. The 7th floor lounge, added as part of the initial repositioning at 10 Grand Central, comprises 7,500 square feet of indoor/outdoor club space equipped with a café, a 40-seat conference space, and The Ivy Terrace, an outdoor space reminiscent of a 1930’s garden party. The building is also home to the MarxMobile, an electric Porsche Taycan that serves as the building’s house car, further blurring the lines between hotel and office.

Studios Architecture, together with Marx Realty’s in-house design team, led the redesign of the building as well as designs for The Meeting Galleries. The building’s notable roster of tenants includes bank holding company Merchants Bancorp; global asset manager Fin Capital; and global independent fund manager DIF Capital Partners. High-profile tenants also include Dwayne “The Rock” Johnson’s production company, Seven Bucks Productions (as reported by the New York Post); insurance giant MassMutual; and, international news agency Agence France-Presse.

Marx Realty leases 20,000 s/f to Riveron at 10 Grand CentralMay 27, 2025

Manhattan, NY Marx Realty has signed a new 20,000 s/f lease with business advisory firm Riveron. The firm, which partners with private equity firms and other capital providers, is relocating from 461 Fifth Ave. and has committed to a 10-year term at the Grand Central office tower. The Meeting Galleries – a new 11,000 s/f amenity, comprising four reservable spaces to accommodate board meetings, corporate retreats, company gatherings, product launches, team building activities, podcast productions and much more – continues to drive leasing activity at 10 Grand Central.

JLL’s Mitchell Konsker, Carlee Palmer, Thomas Swartz, and Nicole Danyi are leading a team handling the leasing for Marx Realty. Peter Trivelas of Cushman & Wakefield represented Riveron.

“We have seen interest in the spaces at 10 Grand Central skyrocket since repositioning the building in 2018,” said Craig Deitelzweig. “It’s not surprising to see firm’s choosing options that give employees an inspiring and collaborative workplace that re-defines a welcoming hospitality-like sensibility at the office. At 10 Grand Central, we’ve perfected this experience, and the recent completion of The Meeting Galleries has further raised the bar by creating a top-to-bottom sensory experience unlike anything in the market today.”

As a complement to the 7,500 s/f indoor/outdoor club floor, added as part of the initial repositioning at 10 Grand Central in 2018, tenants at the building now enjoy The Meeting Galleries which comprises a next-generation ‘town hall’ meeting lounge with seating for 200 guests (The Grand Gallery), a pre-function space (The Bar Car), a sound-attenuated podcast room (The Podcast Gallery) and a theater room (The Screening Gallery). In a nod to nearby Grand Central Terminal, The Meeting Galleries space exudes a luxury train liner aesthetic harkening back to the 1930s when hospitality was king and white glove experiences were reserved only for the elite. Today, a hospitality-infused sensibility combines luxury hotel ambiance with workspace utility.

A floor-to-ceiling bronze fireplace and a green stone bar accented with open shelving and integrated mirror panels provide a striking entrance into The Meeting Galleries space. Finishes inspired by Guastavino tiles complement oversized murals and custom art pieces fashioned in oxidized copper, creating an homage to the many spaces in Grand Central Terminal. Oversized windows with soft, rounded edges mimic those found on train liners and infuse the space with natural light while private nooks with fold-down tables, similar to those found in a luxury train car, add timeless sophistication and contemporary functionality to the space. A variety of plush seating options create an exclusive hotel lobby vibe while oversized gold-backed murals create a ‘garden party’ feel and lend an art gallery-like sensibility throughout the different spaces.

“10 Grand Central has become the benchmark for office design,” said Deitelzweig. “And, as in-person collaboration re-establishes itself as the norm, we are excited to raise the bar with thoughtfully designed, welcoming spaces for tenants to call home.”

“Marx Realty has shown visionary leadership in redefining the tenant experience by embracing a hospitality-driven approach and cutting edge amenities that truly resonate with today’s top-tier tenants,” said Konsker of JLL. “They have set a new standard in the market that continues to attract tenants who want to offer the best experience to their employees.”

The Meeting Galleries is the latest evolution of Marx Realty’s hospitality-infused renovation at 10 Grand Central which, in 2018, included a stunning new façade with marquee brass fins and oversized walnut doors, attended by a uniformed doorman, as well as a redesigned lobby featuring walnut wood and brushed brass accents. The building is also home to the MarxMobile, an electric Porsche Taycan that serves as the building’s house car, further blurring the lines between hotel and office.

Studios Architecture, together with Marx Realty’s in-house design team, led the redesign of the building as well as designs for The Meeting Galleries. The building’s notable roster of tenants includes bank holding company Merchants Bancorp; global asset manager Fin Capital; and global independent fund manager DIF Capital Partners; and investment firm Family Management Corp. High-profile tenants also include Dwayne “The Rock” Johnson’s production company, Seven Bucks Productions (as reported by the New York Post); insurance giant MassMutual; and international news agency Agence France-Presse.

Landlords replace perks including a pool and an old-school boardroom to lure tenants

May 27, 2025

While downtown U.S. offices are fuller these days, some landlords are not only still racing to install appealing features to help lure and keep tenants, they are also doing away with some perks considered no longer relevant.

Take 510 Madison Ave., a 30-story building in New York. Owner BXP recently filled in a two-lane, 20-yard-long lap pool and turned the area into a conference center and coffee bar, Beth Leslie, vice president of construction at BXP, said in an interview.

“When we bought the building in 2010, everybody thought [the pool] was really cool,” Leslie said at a recent office design panel. But “it wasn’t great. Nobody wants to swim with their coworkers.”

Just as smoking rooms have disappeared from office buildings, owners are tearing out dropped ceilings and connecting properties with surrounding streets to meet the latest demands for what’s considered a desirable workplace. Instead of just adding amenities as landlords did right after the pandemic, they are now tweaking and calibrating what they offer to build on gains they’ve made.

The latest focus on amenities comes as the overall U.S. office vacancy rate has reached a record high of 14%, even as it has improved in some markets or in newer buildings, CoStar data shows. Only about half of the 50 largest U.S. office markets have experienced more move-ins than move-outs, or so-called positive absorption, so far in 2025 as first-quarter leasing trends saw companies taking spaces 15%-20% smaller than the 2015-2019 average, according to a CoStar analysis.

Appealing amenities have grown in importance across the United States as major companies including Amazon, Boeing and JPMorgan Chase have called workers back to the office and want to keep them engaged in their workplaces. Employers see updated features as crucial to attracting talent and in the face of post-pandemic hybrid work patterns.

Amenities ‘arms race’

Competing in this “arms race” is crucial as properties that include “a diverse roster of amenities” are expected to see a “12% higher demand from tenants versus their plain commodity counterparts” this year, the brokerage JLL said in a report. Perks with health and wellness, food and beverage, outdoor spaces, and conferencing elements are among the most in demand, different studies have said.

By the 2010s, office landlords sought to replicate the amenities model pioneered in the early 2000s by tech giants such as Google, according to Erin Saven, real estate strategy director at architecture firm Gensler. Nap pods, gourmet food and on-site wellness began popping up in the workplace.

What represents desirable amenities today is still evolving, Saven said in an email, but preferences have shifted “from practical utility to hospitality-driven experiences, redefining how these spaces support office workers in their daily routines.”

Some past projects “overlooked the underlying cultural components” that led to “underutilized and oversized” amenities, Saven said. Landlords now aim to offer “branded, service-driven experiences that anchor a building’s identity and give employees more reasons to look forward to coming into the office,” she said.

Paige Engeldrum, an executive director at Cushman & Wakefield, described health-and-wellness-related perks as key to completing the amenity puzzle.

“When amenity centers were first being constructed, there was such a narrow focus on what health and wellness meant, and it was defined as like a small hotel gym. So a million-square-foot building had this small gym that … nobody wanted to go to,” she said at the design panel, hosted by the New York chapter of Professional Women in Construction.

She said the industry is redefining wellness and moving to create perks that are more “individual” and can meet the needs of employees of different generations and ages as opposed to creating a large-scale gym that was “trying to be everything for everybody.”

Out with the boardroom

In another example of an old amenity making way for a new one, after Marx Realty in 2020 bought the Herald Building at 1307 New York Ave. in Washington, D.C., it removed a boardroom in the lobby, Craig Deitelzweig, Marx’s president and CEO, said in an interview.

Visitors walking into the former Washington Times-Herald building, built in 1923, could see who was in the boardroom right away, potentially tipping off passersby to any confidential meetings inside.

The space “didn’t meet the needs of today’s tenants,” Deitelzweig told CoStar News.

Still, he said, “a boardroom is an important amenity,” adding that today’s tenants “want the exclusivity.” So Marx built a new boardroom, also on the lobby floor, but “tucked away for privacy,” Deitelzweig said. The developer also gave it a different finish, as the old one “was too corporate.” The room’s overhaul also included removing a 10-foot drop ceiling, which at one point was in demand, to create a 27-foot ceiling height.

The upgrades are part of a new 15,000-square-foot amenities space on the ground floor that also includes a gym, lounge, cafe and bar, and the building is expected to be 96% leased this fall, Deitelzweig said. That would give Marx bragging rights, with the D.C. market’s office vacancy rate at a near-record high of about 17%, CoStar data shows. The updates also made a big difference in cash flow: Per-square-foot rents have jumped to the $70s and $80s from the mid-$20s when Marx bought the property, Deitzelweig said.

Marx, which also owns Manhattan properties such as 10 Grand Central, employs a similar playbook in outfitting properties with hotel-like amenities, including a house car to shuttle tenants around.

Deitelzweig said all of its New York office properties are about fully leased. “We look at our amenities space as a club,” he said.

Connecting tenants with the community

Marx Realty isn’t the only landlord that seeks to make its amenities space more like a private club or present a luxury hotel vibe.

Gensler in recent years redesigned the third floor of the former IBM Building at 590 Madison Ave. in Manhattan from a dining, training and conference amenity to a hospitality-inspired amenity spanning 25,000 square feet. Perks include a full-service bar, multisport simulator, library, cafe and meeting areas.

Tiffany Rufrano, asset management director for the State Teachers Retirement System of Ohio, which owns 590 Madison, said the change came as what had been a single-tenant officer tower evolved to become a multi-tenant property.

The state’s retirement system agreed to sell the property to RXR Realty for $1.1 billion, according to media reports.

Sometimes the amenities involve the outdoors. Onyx Equities’ bid to reimagine the Gateway Center, a 1970s office complex in Newark, New Jersey, involved rethinking skybridges, building lobbies, and the food and beverage offerings, said Dana Nalbantian, principal at Gensler.

The pedestrian walkways, connected to Newark Penn Station, were originally built to “create a sense of safety and ease” for commuters during a time of civil unrest so they wouldn’t have to access the streets in the city, Nalbantian said. The 1.6 million-square-foot office complex now reconnects tenants to the street level and invites visitors in as office designs are increasingly about incorporating tenants and their employees as part of their communities.

The ground floor of the Gateway One building at the complex has been opened up to create a large glass atrium entrance with new food and beverage amenities, keeping the connection to the outside while the skyways remain for direct access to the train station.

As for BXP and 510 Madison Ave., the building has also kept a connection to the past with its renovation, leaving a gym on the same floor where the lap pool was scrapped. The pool “went very much unused,” construction executive Leslie said. “Amenities are a baseline. You do need them … but they have to be the right ones.”

Marx Realty Signs 16,000 SF of Leases at The Herald Office Building in D.C.May 13, 2025

WASHINGTON, D.C. — Marx Realty has signed 16,000 square feet of new and expanded leases at The Herald, a 114,000-square-foot office building located at 1307 New York Ave. in Washington, D.C. The deals include two new leases: a 5,000-square-foot, eight-year lease with Auburn University’s non-partisan think tank McCrary Institute and a 3,200-square-foot, six-year deal with public policy strategy firm August Strategy Group.

Additionally, an undisclosed government affairs agency has nearly doubled its footprint at The Herald, expanding by 7,800 square feet. The office building’s amenities include a rental 2023 Tesla Y car, 40-seat boardroom, café, lounge and a fitness center with boxing facilities, private workout rooms, Pelotons, Hydro rowers and a mirror fitness system.