By Andria Cheng | December 19, 2023

French luxury crystal label Baccarat is expanding its New York office footprint in a planned relocation to a renovated boutique office building a few blocks south of its current home.

Baccarat will relocate its Manhattan office to a 10,000-square-foot penthouse and mezzanine space, including a private terrace, on the 18th floor of 545 Madison Ave. by French Luxury Brand Baccarat To Relocate Manhattan Office 55th Street, landlord Marx Realty said Monday in a statement. Baccarat is moving from its space just four blocks north at 635 Madison Ave., where it occupies 5,809 square feet, a Marx Realty spokesperson told CoStar News.

Baccarat’s new lease lasts 11 years with an asking rent of $135 per square foot, the spokesperson said. The brand’s retail location will remain in its current building just north of 59th Street.

As part of the luxury brand’s planned move, 545 Madison will co-brand with the luxury house and install its logo near the building’s entry marquee. Marx also will feature Baccarat’s crystal chandeliers as well as other luxury goods in its lobby and at its exclusive tenant lounge and terrace amenities space on the eighth floor.

“We proposed this partnership to Baccarat as we knew it would represent the perfect coupling of the 545 Madison brand and the Baccarat brand and would best reinforce the building’s position at the intersection of office, luxury, and hospitality,”Craig Deitelzweig, Marx president and chief executive, said in the statement.“It’s the next step in blurring the lines between the office and hotel experiences while aligning with the regal elegance of the Baccarat brand.”

Deitelzweig has been adopting hotel-like amenities and designs in Marx’s office portfolio to help attract tenants as New York’s vacancy rate has jumped to what CoStar data shows as a record high of 14%.

For instance, after the developer bought 545 Madison in late 2019, it renovated the building during the pandemic with hospitality elements and finishes, including warm walnut wood, velvet and bronze.

A uniformed doorman is stationed outside each office property, Deitelzweig has previously told CoStar News. 545 Madison has an occupancy rate of 90%, the Marx spokesperson said. That equates to a vacancy rate of 10%, below CoStar’s city average and the 13.3% rate in the Plaza where the building sits.

At another Marx property, 10 Grand Central, Marx last year introduced a hotel-like house-car concept to whisk office tenants around Manhattan. Vacancy at that building is about 10.5%, also below market average, CoStar data shows.Baccarat, for its part, is no stranger to hospitality. Its namesake luxury hotel is nearby at

At another Marx property, 10 Grand Central, Marx last year introduced a hotel-like house-car concept to whisk office tenants around Manhattan. Vacancy at that building is about 10.5%, also below market average, CoStar data shows.

Baccarat, for its part, is no stranger to hospitality. Its namesake luxury hotel is nearby at 28 W 53rd Street.

For the Record

A Cushman & Wakefield team of Tara Stacom, Harry Blair, Peter Trivelas, Remy Liebersohn, Connor Daugstrup and Bianca Di Mauro represented Marx in the transaction. Lantern Company’s Matt Siegel and Jessica Adler represented Baccarat. David Burns and Kristin Kaiser of Studios Architecture worked with Marx’s in-house design team to re-imagine the lobby and amenity spaces at 545 Madison.

Baccarat to Move Office to 545 Madison with 10K-SF LeaseBy: Emily Fu | December 18, 2023

Marx Realty has announced that Baccarat will relocate its corporate offices to a 10,000-square-foot penthouse and mezzanine space – including a private terrace — on the 18th floor at 545 Madison Avein the Plaza District.

“We proposed this partnership to Baccarat as we knew it would represent the perfect coupling of the 545 Madison brand and the Baccarat brand and would best reinforce the building’s position at the intersection of office, luxury, and hospitality,” said Craig Deitelzweig, president and CEO of Marx Realty. “It’s the next step in blurring the lines between the office and hotel experiences while aligning with the regal elegance of the Baccarat brand.”

A Cushman & Wakefield team of Tara Stacom, Harry Blair, Peter Trivelas, Remy Liebersohn, Connor Daugstrup and Bianca Di Mauro represented Marx Realty in the transaction. Lantern Company’s Matt Siegel and Jessica Adler represented Baccarat.

Marx Rebranding 545 Madison Office Property With Crystal Maker BaccaratBy Abigail Nehring | December 18, 2023

Baccarat also signed on for 10,138 square feet at the Plaza District property

French fine glassmaker Baccarat is relocating its New York office and leaving a shimmering trail in its wake.

Landlord Marx Realty plans to rebrand its office property at 545 Madison Avenue with Baccarat as part of the deal, installing Baccarat crystal chandeliers and barware in the lobby and tenant lounge, the New York Post first reported.

Aside from the branding agreement, Baccarat signed an 11-year lease for 10,138 square feet on the top floor of the 18-story building, according to Marx. Asking rent was $135 per square foot.

The move will increase the size of Baccarat’s New York office footprint by 75 percent from its current 5,809 square feet at 635 Madison Avenue, four blocks north of its new address. The brand’s retail location on the ground floor of 635 Madison will stay put, a Marx spokesperson said.

Baccarat was founded in the 18th century and is still based in its namesake Baccarat in northeast France. It has been in the hotel business for close to a decade. It opened the 116-room Baccarat Hotel with Starwood Capital at 29 West 53rd Street in 2015.

“They’ve been around for 260 years. It made so much sense to collaborate on the building,” Marx President and CEO Craig Deitelzweig said. “Our buildings are hospitality-inspired, and they have the Baccarat hotels.”

Deitelzweig added that tenants are increasingly seeking luxurious amenities, and Marx Realty has been trying to oblige.

Marx dropped $100,000 last year on a Porsche Taycan emblazoned with the landlord’s logo to shuttle tenants of its 10 Grand Central office tower around Midtown.

Now, the landlord will outfit 545 Madison’ eighth-floor Leonard Lounge with Baccarat pendant lights and its Lady Crinoline chandelier.

“The experience that the building offers is the No. 1 thing tenants look for,” Deitelzweig said. “It feels like a social club, but it’s for the tenants in the building.”

Financial software developer Strike Technologies is one of the oldest tenants in the building. Others include private equity firms Snow Phipps, Kohlberg & Company, Vialto Partners and Orangewood Capital.

Cushman & Wakefield (CWK)’s Tara Stacom, Harry Blair, Peter Trivelas, Remy Liebersohn, Connor Daugstrup and Bianca Di Mauro brokered the deal for Marx, while Baccarat was represented by Lantern Real Estate’s Matthew Siegel and Jessica Adler.

C&W’s brokers declined to comment. Siegel and Adler did not immediately respond to a request for comment.

French luxury crystal line Baccarat to move its New York City officeDecember 18, 2023 | By Julian Nazar

Baccarat is moving its New York City office to 545 Madison Ave.

Baccarat, a French luxury crystal line, has a signed an 11-year lease to move its New York City office to 545 Madison Ave.

The 10,000-square-foot penthouse and mezzanine space is on the 18th floor and includes a private terrace. In addition, Baccarat will have its crystal pieces displayed throughout the building as part of co-branding partnership with building owner Marx Realty.

Asking rent was $135 per square foot.

Baccarat is relocating its New York City office from 635 Madison where it spent the past seven years.

Cushman & Wakefield’s Tara Stacom, Harry Blair, Peter Trivelas, Remy Liebersohn, Connor Daugstrup and Bianca Di Mauro represented Marx Realty on the deal. Lantern Real Estate Advisors + Partners’ Matt Siegel and Jessica Adler represented Baccarat.

“We proposed this partnership to Baccarat as we knew it would represent the perfect coupling of the 545 Madison brand and the Baccarat brand, and would best reinforce the building’s position at the intersection of office, luxury and hospitality,” Marx Realty CEO Craig Deitelzweig said in a statement. “It’s the next step in blurring the lines between the office and hotel experiences while aligning with the regal elegance of the Baccarat brand.”

The property features the “Leonard Lounge,” named after Marx Realty founder Leonard Marx, on the eighth floor, which includes a 7,000-square-foot café, a 2,000-square-foot landscaped terrace, a 40-seat boardroom and a ceiling-suspended fireplace.

Notable tenants at the property include financial software and applications developer Strike Technologies and private equity firms Snow Phipps, Kohlberg & Co., Vialto Partners and Orangewood Capital.

December 18, 2023 | By: Holden Walter-Warner

Luxury crystal company leasing 10K sf for US HQ

Baccarat CEO Maggie Henriquez and Marx Realty CEO Craig Deitelzweig with 545 Madison Avenue (Getty, Marx Realty, Google Maps)

If amenities won’t bring employees back to the office, one landlord is hoping the sight of crystals will.

Marx Realty signed a deal with Baccarat to rebrand the office building at 545 Madison Avenue, the New York Post reported. The rebrand is the first in the office space for the French luxury crystal company, which has a branded hotel on West 53rd Street.

The financial terms of the arrangement were not reported. In addition to an updated name, the Midtown Manhattan property will feature Baccarat chandeliers in the lobby and common areas, Baccarat barware in the lounge and company branding on the ground-floor windows.

The rebrand comes after Marx spent $24 million to upgrade the property, including transforming the lobby, along with adding a library and tenants’ club floor.

Baccarat is shifting its U.S. headquarters from 635 Madison Avenue — where it will retain a store — to 10,000 square feet at 545 Madison. The company is paying $135 per square foot, the ceiling of asking rents at the property.

The 145,000-square-foot property is 90 percent leased, according to Marx CEO Craig Deitelzweig. Last year, real estate firm Ogden CAP Properties, the real estate arm of the Milstein clan, signed a three-year renewal of its 42,000 square feet at the building through 2027.

Marx took control of the property in 2019, evicting Joe Sitt’s Thor Equities from a ground lease after months of unpaid rent and outstanding real estate taxes.

While this is Baccarat’s first branded office building, the company’s name is on the hotel at 28 West 53rd Street in Manhattan and could be coming to a luxury condo development in Miami, too. That project’s future is murky, however, after artifacts and both human and animal remains dating thousands of years were discovered during the excavation of the site.

Baccarat signs branding deal with owners of 545 MadisonDecember 18, 2023 | By: Steve Cuozzo

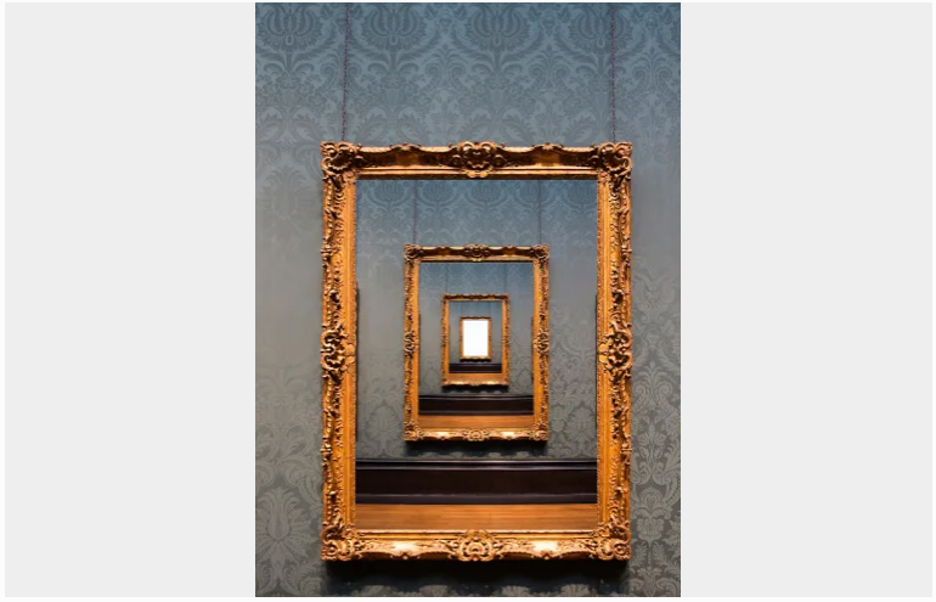

There’s a Baccarat hotel on West 53rd Street. Soon, there will be a Baccarat-branded boutique office building, too.

The French luxury crystal line is moving its US office headquarters from 635 Madison Avenue, where it has an elegant store, to Marx Realty’s 545 Madison Ave. — which would make the boutique property possibly the first office tower to identify itself with a luxury brand.

Baccarat signed for 10,000 square feet. But the deal with Marx goes beyond the space commitment. The 260-year-old brand’s esthetic will be “woven into the fabric of the building,” Marx CEO Craig Deitelzweig said, “to complement its hotel-like sensibility.”

Baccarat chandeliers will soon adorn the lobby and public areas and its barware will be used in the lounge. The ground-floor window will have the Baccarat name’s distinctive logotype.

“It will be their first branded office building,” Deitelzweig said. “It started when they were looking for new office space. They liked the way 545 Madison looked, it was in synch with their brand, and then we started talking about a kind of partnership.”

Marx previously spent $24 million to juice up the property with a hotel-like lobby, a tenants’ club floor, library, walnut and bronze trim, and curved lobby surfaces.

The tower’s 145,000 square feet are 90 percent leased, Deitelzweig said. Asking rents range from $86 to $135 per square foot — the highest figure applying to the Baccarat space.

2023 Commercial Real Estate Visionaries: Craig Deitelzweig of Marx RealtyNovember 14, 2023

Craig Deitelzweig manages 5 million s/f of commercial office, retail and residential space and oversees development, construction, leasing and property management. His vision for future-proofing the office and retail sectors provided office and retail tenants with holistic sensory experiences before they even knew they wanted or needed them.

What recent project, transaction, or accomplishment are you most proud of?

My pioneering strategy to infuse a hotel-like sensibility into office spaces became a benchmark in commercial real estate with a distinctive aesthetic inspired by the world’s finest hotel properties. Marx Realty’s office assets in New York City are thriving and the 1.5 million s/f Cross County Center Yonkers, NY is growing.

November 6, 2023

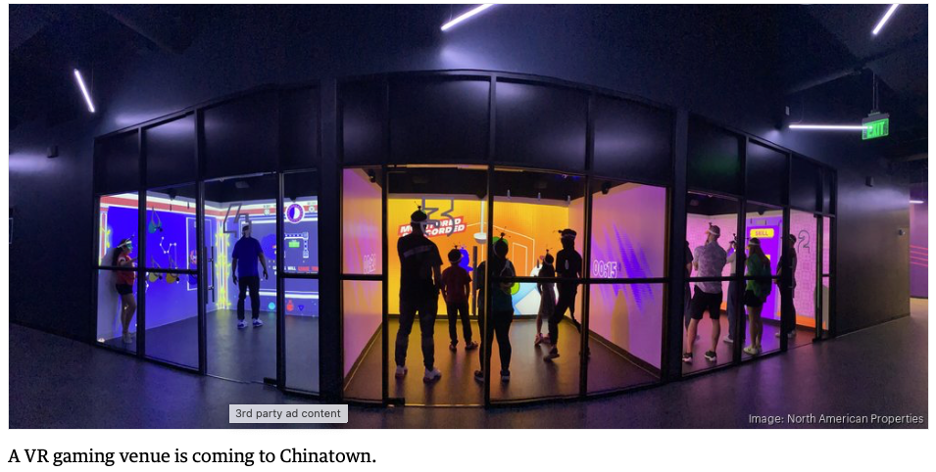

Immersive Gamebox, an experiential retailer that features virtual reality-style games with aliens, “Paw Patrol” characters and more, has signed on for 4,500 square feet inside a D.C. office building.

It will be the first Immersive Gamebox in the District and the second in the region. The London-based company opened a 2,217 square-foot location in Arlington’s Ballston Quarter mall in 2022.

The D.C. venue will be located at Marx Realty’s The Grogan office building at 819 7th Street NW in D.C.’s Chinatown. The 21,000-square-foot building is named after a furniture store that occupied the building in the early 20th century. Immersive Gamebox is taking both street-level and lower-level space in the building. Part of that space previously housed D.C.’s first-ever Nando’s Peri-Peri.

Immersive Gamebox was represented in the deal by Logan Chambers Powell at Dochter & Alexander Retail Advisors and Marx Realty was represented by Lindsey St. Maxens and Jennifer Price at KLNB.

Marx purchased the building in 2018. It said it has launched an overhaul of the building that will include new entry doors, updated façade and renovated lobby. The mezzanine level of the penthouse will be remade into a collaboration space with café and city views.

Marx Realty also owns two other D.C. office buildings: The Herald, at 1307 New York Ave. NW and One Glover at 2121 Wisconsin Ave. NW.

Immersive Gamebox currently has more than a dozen U.S. locations, with plans for many more in the years ahead.

New York’s Owners On Who They Are in ‘Succession’Logan Roy, Lawrence Yee, the waiter who drowned — the answers came fast and furious from owners — but so did the no-comments

By Max Gross | November 7, 2023

The HBO show “Succession” is not about real estate. … Or, is it?

Certainly, “Succession” is about a prominent New York family (whose real-life inspirations rhyme with Shmerdoch and Shmedstone); it’s about familial politics; it’s about ego; it’s about money; it’s about power.

It sure sounds like a plausible real estate show.

Of course, no, the Roy family is in media, not real estate. But the switch could have been executed with very little editing. One of the things that makes real estate such an interesting topic (especially in New York) are the family dynamics. Great wealth is handed down from generation to generation. Sometimes it is bickered over, divided and sold off. Sometimes it is compounded and becomes a legacy that renders its heirs inordinately influential people.

“Succession” probably captures those battles, triumphs and head games better than any other show on television.

To be sure, the characters on “Succession” — from the cold, mercurial patriarch Logan; to his wackadoodle son Connor; to Logan’s feckless heir Kendall; to his giggly, immature son Roman; to the shrewd sister Shiv; to his cringing, bumbling nephew Greg — are at best strange, but more often selfish and cruel. They’re certainly not figures to emulate.

But everyone who admires the show (even us humble journalists) have daydreamed about who we are in its bizarre pecking order, or how we’d react if we were beholden to a moody Scottish tycoon for billions of dollars. When asked which character he identified with in the “Succession” universe, Brookfield’s Ben Brown answered, “Only the flawed ones.”

Got it — all of ’em.

A majority of CO’s owners did not cop to watching the show.

“Never seen it,” said Will Blodgett. “From what I heard, it would make me lose faith in humanity. I love humanity.” Well, then, no, you shouldn’t watch “Succession.”

“I don’t relate to any of those characters,” said Marx Realty’s Craig Deitelzweig. “People often say I remind them of Harvey Specter from ‘Suits.’ ”

“I got bored after the first season,” said Michael T. Cohen. (Quick: Where’s our fainting couch?!)

Many identified with the more minor characters: Jason Alderman likened himself to Ewan Roy, Logan’s irate brother; Douglas Durst said Lawrence Yee, the founder of Vaulter who holds the Roy family in massive contempt (it’s a good answer); Jake Elghanyan said Gerri, the company’s general counsel who is herself an adept player of family politics (also a good answer); one owner said the catering waiter who accidentally drowns at a Roy family event. (Well, he was at least less morally culpable than the rest. The only really wrong answer would have been Tom, Shiv’s half-bullying, half-suck-up husband who no normal person could possibly like.)

But a few were willing to admit their fascination (and affection) for the main attractions.

“Kendall Roy,” said Aurora’s Jared Epstein of the heir apparent to the Roy throne.

“Logan Roy — building something from scratch,” said Tawan Davis. (Finally someone will admit this!)

“I suppose I am most like the father, Logan Roy,” said Jeff Gural, adding, “but I’m nowhere near as conniving.”

“I guess it is the CEO as I look forward to my two children playing a larger role with increased responsibilities in our organization,” said John Catsimatidis.

“Logan Roy,” answered Keith Rubenstein. (Without elaboration. Like a boss.)

Of course, “Succession” impacted some of our owners in more tangible ways.

“While they filmed season three in the Woolworth Tower Residence and I personally enjoy the show, I’m like none of the characters,” said Alchemy’s Ken Horn.

New York City Commercial Real Estate Owners Look AheadNovember 7, 2023

To 2026 and into the next decade…

There is an inner soothsayer in every decent real estate developer.

They have placed a significant bet on the future: What can rise on an empty plot of land? Who must they tap to make this vision a reality? How will this hypothetical building fit into the greater landscape? Who will buy or rent this property?

Likewise, buyers and sellers of real estate have to make a prediction about what the financial conditions of the city (or the country) will look like as they decide the composition of their portfolios.

Real estate is such a long process that without some sense of where the future was going all business would grind to a halt.

Some of these owners or developers keep their heads down and trust in the hoary (if accurate) wisdom, “Never bet against New York.” They have waited out interest rate hikes and crime waves in the past, and they can do so again.

Others have pulled up stakes and turned to the secondary and tertiary markets, where the land is cheaper, the tax incentives are more plentiful, and the zoning boards aren’t quite so territorial.

Still others have looked at asset classes and products that they had never touched before and decided this is where the future lies.

However, the thing that’s been so vexing about the last few years is how much our internal oracles have failed us. Since the turn of the century, the U.S. has been embroiled in a slew of crises that not even Cassandra would have anticipated. Anyone who thinks they know what will happen tomorrow, much less a decade out, is almost always wrong.

“Ten years out is a bit too far to prognosticate,” said Savanna’s Nicholas Bienstock.

Yes, that’s absolutely true. Still, decisions need to be made here and now that will bear fruit five or 10 years down the line.

In this Owners Magazine, we asked the 36 men and women we polled to dig deep and tell us what they would be doing three years, five years and 10 years hence. Some skipped the 10-year part of the question. But enough answered to paint a fascinating portrait of how owners see the real estate landscape. (And you can always look directly at the source to see the answers in full.)

2026

To a certain extent, the next three years will remain defensive for a lot of owners.

“Our portfolio will diversify,” said Michael T. Cohen of Williams Equities. “Today it’s 100 percent office and retail, but I expect it will come to include other types of assets. We’re also looking to grow the portfolio and take advantage of the likely buyer’s market.”

Indeed, prices have been coming down in New York office for some time now, and one should expect a number of well-capitalized owners to pounce when the market has reached bottom — and many are making plans accordingly.

“Just in the last 20 months or so, we have purchased nearly half a billion dollars in property, primarily funded by dispositions of suburban assets, and diversified into residential to become a New York City-focused portfolio,” said ESRT’s Anthony Malkin. “Over the next three years or so, we think there will be an improved opportunity to buy property.”

It’s “similar in nature to what we last saw following the Global Financial Crisis,” said Bienstock. “At that time, Savanna was one of the most active buyers of distressed debt-to-equity transactions in New York. We see a similar opportunity emerging as we go into 2024.”

“2026 will be Marx Realty’s best-performing year in our history,” Craig Deitelzweig predicted boldly. “We are just beginning to see significant opportunities to purchase and reimagine bland office properties and to transform them with the Marx brand of hospitality-infused office properties.”

But, while New York remains important for many owners, a lot of developers and owners have been looking beyond Gotham in their hunt for yield.

“Over the last five years, we have had continued success in building our platform outside of New York City — in New Jersey, Pennsylvania, Westchester and Connecticut,” said Jason Alderman of Hines. “This activity has generally been non-office, focusing on multifamily acquisitions and development and expanding our industrial platform.” Hines expects more of the same in 2026.

Of course, plenty are following a multi-pronged approach of being in New York and beyond. Savanna, for instance, isn’t strictly focused on New York; they’re in the process of building The Olara, a 1.6 million-square-foot condo and rental in West Palm Beach, Fla.

“By 2026, BRP Companies is anticipated to have doubled in size when compared to the firm’s 2021 stature,” said Meredith Marshall of his firm. “This growth is being driven by our active involvement in a substantial volume of transactions across New York, New Jersey, the mid-Atlantic and the Southeast.”

2028

Some are already laying out big plans for the next five years.

“We will have completed $5 billion of new P3 [public private partnership] developments,” said Don Peebles of the Peebles Corporation. “Angels Landing in L.A. and Affirmation Tower in New York will be under construction.”

“We are working on at least two … large-scale, long-term development plans that we expect will keep us on a pace of adding approximately 2,500 units to our portfolio every five years,” said TF Cornerstone’s Jake Elghanayan. “In terms of new business, we think there is a compelling office-to-residential conversion opportunity nationally, and so, five or 10 years from now, I would hope we begin to see the fruits of that labor.”

“We expect our total assets under management, today at $850 billion, to grow to roughly $2 trillion over the next five years,” said Brookfield’s Ben Brown. (Brown declined to be specific, but that should certainly tantalize all readers.)

Whatever else happens in New York City in the next five years, the demand for affordable housing will not be met. And that’s a big opportunity for owners.

“Our goal for 2028 and beyond is to build outside of the inner-city market in neighborhoods where the implementation of crucial affordable housing is key to their survival,” said BFC Partners’ Joseph Ferrara. “We have set our internal goals to always have a minimum of 1,000 units in construction and to add a minimum of another 2,000 units to our asset portfolio by year-end 2028.”

There are certainly more owners who think New York City will rebound and recover by that point.

MAG Partners will be “operating and building in multiple cities, and looking back and laughing at all those who said New York City was dead,” predicted MaryAnne Gilmartin. “And were wrong — again.”

One fair prediction would be that predictions change.

“Our approach is the opposite of the family real estate dynasties in New York City,” said Wildflower’s Adam Gordon. “For them, grandpa was savvy and entrepreneurial and built a fortune, which he passed onto future generations. … [Wildflower] operates more like a sports team than a family. The health and success of the franchise relies on fresh talent. When the talent has earned their Super Bowl rings and made their retirement earnings, they leave the team to find other adventures, and young and hungry talent takes their place. It’s an organic process much like the cycles of nature.”

2033

It’s here that the thinking becomes broadest.

“Long-term planning is what we do,” said Howard Hughes Corporation’s David O’Reilly. “In 10 years, we will have significantly advanced our development pipeline — starting with the roughly 30,000 residents who will be living in our community of Teravalis in the Phoenix West Valley as we launch into the next phase of master planning and development beyond Teravalis’ first neighborhood of Floreo.” Howard Hughes will also be concentrating on the Lakefront District in Downtown Columbia in Maryland; The Woodlands, in Texas; its movie studio business in Summerlin, Nev.; and Ward Village in Hawaii.

But, it’s rare to have megaprojects like that to focus on. Instead, by necessity, many owners that we polled spoke about three things: technology, climate change and housing.

“Over the next decade, we will continue to reinvest in our core commercial buildings to meet the rapidly evolving needs of our tenants,” said Fisher Brothers’ Winston Fisher. “This will include seamless integration of AI technologies into our buildings and embracing the digital world in our physical assets.”

“We will further enhance our commitment to sustainability and technology, revolutionizing the industry,” said Time Equities’ Francis Greenburger.

Energy consumption will be critical, no matter which side of the political aisle one inhabits. “Continued growth in real estate, continued growth in the energy sector with both fossil fuels and safe, efficient nuclear energy,” said Red Apple Group chairman (and former mayoral candidate) John Catsimatidis about his company’s priorities over the next decade.

Given the expectation that more than half a million more housing units would be needed to keep up with population growth in New York City by 2030, housing (and affordable housing, specifically) is on many minds.

“In a perfect world, we will have created some really dynamic public/private partnerships by then to allow us to build affordable housing with social services components,” said Charney Companies’ Sam Charney.

“The affordability crisis together with climate change are the most pressing issues our society faces, and it’s up to my generation to grab the baton and make serious headway in solving it,” said Tredway’s Will Blodgett. “It’s now or never.”